Problem Statement:

The entry of Input Tax Credit on expenses via a purchase voucher is causing an incorrect classification in the VAT GCC report, specifically placing the transaction under the "Purchase from Non-registered tax-payers, zero rated/exempt purchases" section.

Solution: Ensuring Correct VAT GCC Reporting for ITC on Expenses

To ensure the Input Tax Credit (ITC) claim on expenses is correctly classified under the "Standard rated domestic purchases" section of your VAT GCC Report, please follow these three steps:

Step 1: Pre-Requisite Setup

Before creating the purchase voucher, you must create the necessary ledger accounts and service items:

Create a New Expense Account: Go to your Chart of Accounts (or All Accounts). Create a new account under Direct Expense (e.g., "Office Rent").

Create a Corresponding Service: Go to Service. Create a new Service Item using the exact same name as the new expense account you just created.

Step 2: Creating the Purchase Voucher

When recording the purchase voucher for the expense, follow these specific steps:

Set the voucher entry mode to "On Total".

In the Purchase Account field, select the Direct Expense account you created in Step 1.

In the Service/Item field, add the Service Item you created in Step 1.

In the Tax Account field, select the relevant tax ledger (e.g., VAT@5%) and enter the tax amount.

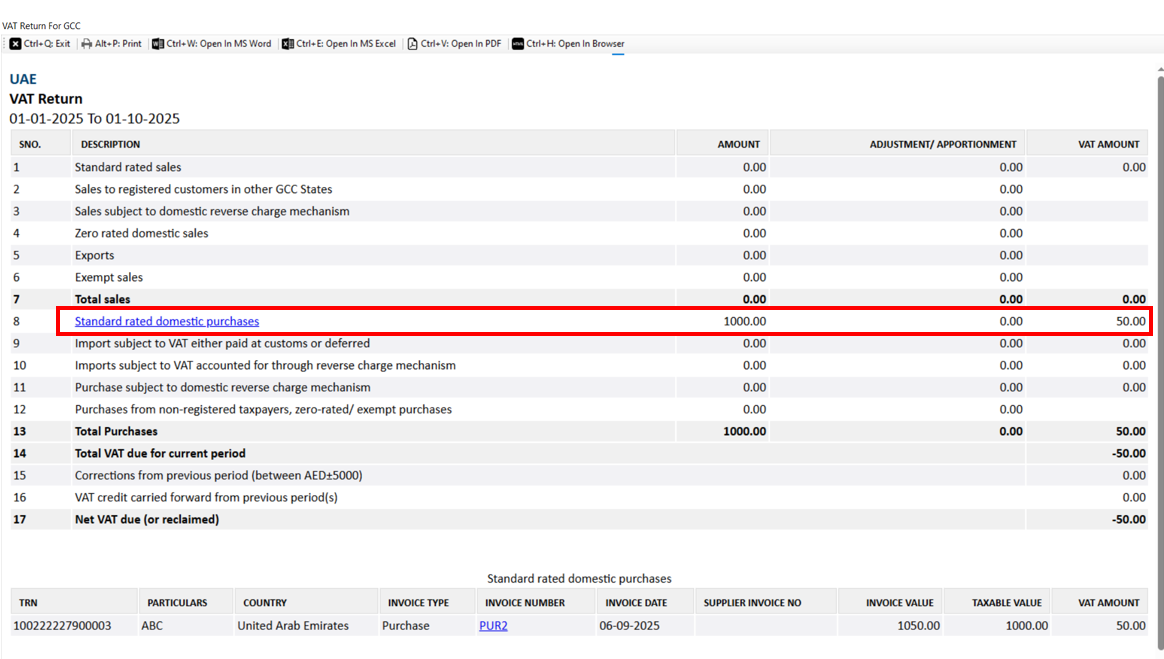

Step 3: Verifying the VAT GCC Report

After saving the voucher, the impact of this entry will now be correctly recorded.

When you check the VAT Return for GCC report, the transaction will be accurately classified under the "Standard rated domestic purchases" section.

Still you have any doubts, please connect us over our number: +91-9999176746 or even drop us a mail at Support@bookkeeperapp.net

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article